Benefits of Having a Personal Budget

THERE ARE GREAT BENEFITS TO HAVING YOUR OWN PERSONAL BUDGET.

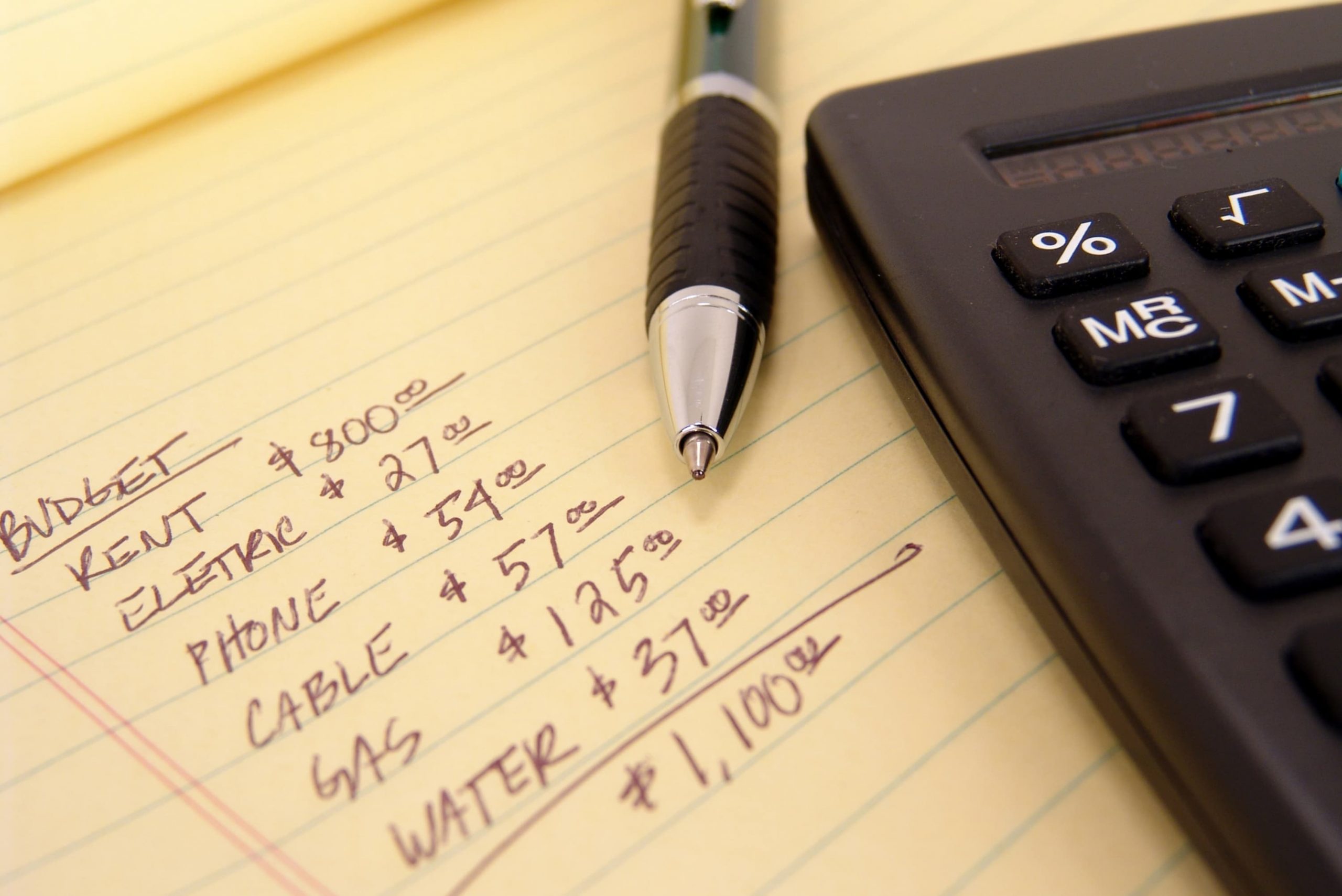

Having a personal budget is essential to gaining control of your personal finances. Budgeting doesn’t necessarily mean restriction; it frees up your money, so you know exactly what’s available to spend.

CONTROL

Developing your personal budget gives you control over your money. You’ll know how much cash you’ll have coming in and can make a plan for how to spend it.

GOALS FOCUSED

Everyone should have goals for their money. Whether this is paying off debt, increasing your savings, or freeing up more cash to invest in your business, a personal budget will keep you focused on achieving these goals.

WHERE YOUR MONEY GOES

Have you ever looked at your personal drawings from your business and thought ‘we can’t possibly have spent that much money last year!’? You’re not alone. So many people really have no idea what they spend their money on. Having a personal budget creates transparency about what you spend your money on. It might just surprise you on how much money you spend on something, like that daily coffee from the cafe.

BUILD BETTER MONEY HABITS

Reviewing your actual results against your budget each month will encourage you to think about your spending before you spend. So put that column in your personal budget that allows you to compare what you actually spent, to what you thought you would spend.

GET READY FOR WORK

Brush your teeth, do your hair, put on some work clothes. This will mentally prepare you for work and also set that boundary between work and play. You don’t have to wear a suit or corporate clothes, but do wear something decent enough to attend a work meeting on Zoom. You will feel much better about yourself if you’re in some appropriate clothes. Maybe it’s even that time to wear those unbelievably gorgeous shoes you bought on holidays last year, but haven’t had the place to wear them out yet.

MANAGE YOUR DEBT

You’ll be able to plan for unexpected expenses instead of obtaining debt to pay for emergencies. You’ll also be able to allocate more money to debt repayments to become debt free faster. A personal budget will also mean you will never miss a bill. How many times has car registration turned up and you’re like, oh my god, forgot about that? A personal budget makes sure expected and unexpected expenses can be paid for.

EARLY WARNING SYSTEM

By regularly monitoring your spending, you’ll quickly identify upcoming costs and adjust your spending if required. You can compare the cash in your bank account, with expenses you know are coming up and adjust your daily spend to make sure you’ve got enough. If you have surplus you can then top up savings, or buy that lovely shirt you’ve had your eye on, and feel good about the purchase.

COMMUNICATION

Spending time developing your personal budget with your spouse will ensure you’re aligned with your spending plan. A personal budget will also help avoid those unpleasant discussions or arguments around savings, spending and having enough money to pay for the school fees or family Christmas presents.

Personal budgeting doesn’t have to be a time-consuming process. Dedicating 1-2 hours a month to budgeting will result in a huge improvement; not only to your bank account, but to your stress levels too. Don’t know where to start? Why not talk to one of our accountants or advisors. We have templates and spreadsheets available for you, so that you can make a good start.

– 18 November 2020 –

General Advice Warning

In preparing this article, Praescius Financial Consultants NSW Pty Ltd, Praescius Financial Consultants NT Pty Ltd, Praescius Financial Consultants HB Pty Ltd and Praescius Financial Brisbane Pty Ltd have not considered your personal circumstances, goals or objectives; as such the information, commentary and assertions made within this article may not be suitable to you. Please seek personal financial advice prior to acting on this information, or making a decision regarding the choice of a financial product or strategy. Further information and disclosures can be found in our Financial Services Guide or by contacting us on the phone numbers provided.

Praescius Financial Consultants NSW Pty Ltd, Praescius Financial Consultants NT Pty Ltd, Praescius Financial Consultants HB Pty Ltd and Praescius Financial Brisbane Pty Ltd are authorised representatives of Praescius Financial Holdings Pty Ltd ABN 14 610 960 980 AFSL 486455, 2a/57-59 Oxford Street, Bulimba Qld 4171.

More from insight in action

2021-22 Federal Budget

On Tuesday, 11 May 2021, Treasurer Josh Frydenberg handed down the 2021-22 Federal Budget, his 3rd Budget.

Increase your tax refund

Here are a number of ways and actions you can take to increase your tax refund. Contact our accountants after reading more here:

Teaching kids about finance

With current interest rates near zero, it makes sense to consider refinancing your home to lower costs. Read more here to find out how:

Ben Ades

Ben Ades

Karina Yates

Karina Yates